Each company registered (LLC or Corporation) in Delaware in the United States must pay an annual tax of US$300 (amount for 2021).

The tax payment must be made by June 1st of each year. It is essential to pay on time. Otherwise, the amount due will be higher.

If the tax remains unpaid after the due date, a penalty of $200 will be imposed. In addition, an interest rate of 1.5% per month will be applied until the tax and penalty are paid.

And if any balance remains unpaid on June 1, the LLC or Corporation will cease to be in good standing.

Contents

1st step: identification of Delaware company

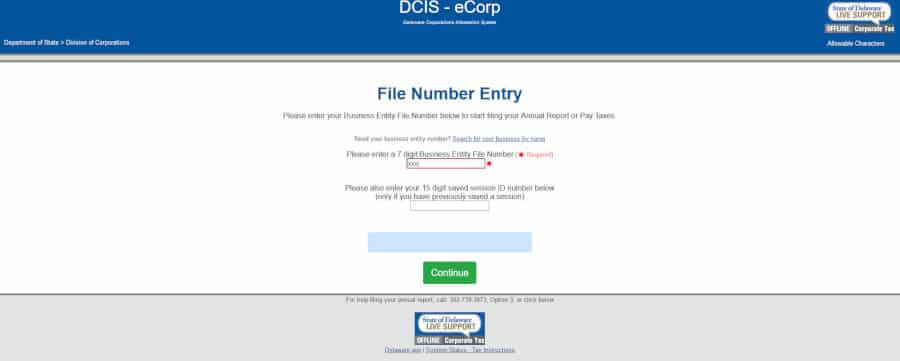

To pay the tax, you must go to the following web address: https://icis.corp.delaware.gov/Ecorp/login.aspx?FilingType=FranchiseTax

- Enter the LLC or Corporation’s Delaware state identification number in the first box and leave the second box blank.

- Click on the button “Continue”.

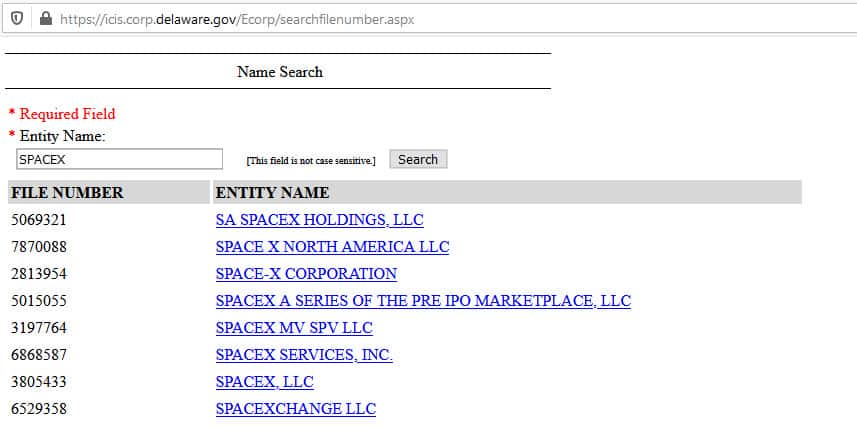

If you don’t remember the identification number, you can search for it with the link “Search“:

2nd step: new identification of Delaware company

- Re-enter the LLC’s Delaware state-corporate ID number in the first box, and always leave the second box blank.

- Click on the button, “Continue“.

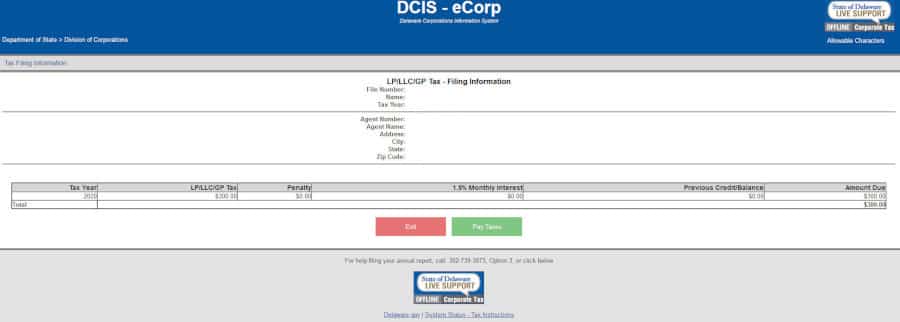

3rd step: Tax Filing Information

At this step, you must verify that all information is correct. It is also at this stage that you will see the taxes and interest to be paid.

- Click on the button “Pay Taxes“.

4th step: payment of annual Delaware tax

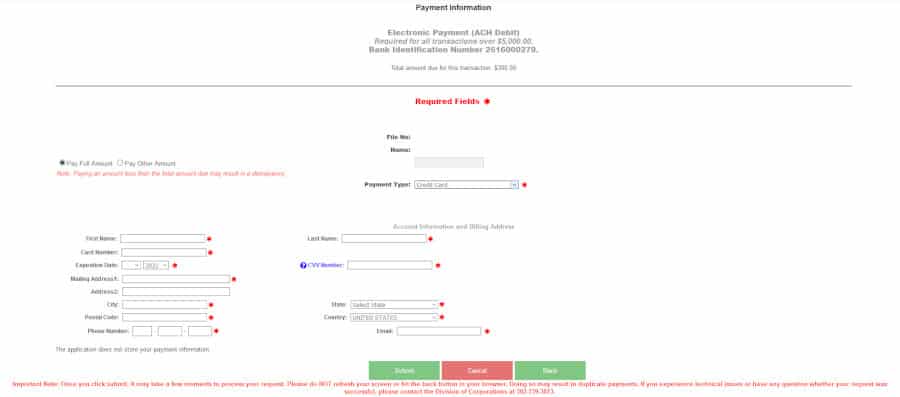

You can pay by “credit card” or “ACH Debit”. The credit card payment system is the easiest. Please note that it is impossible to deliver to the State of Delaware via PayPal, check, bank transfer, or Western Union.

You must fill in your credit card information and all fields with a red star.

Once you have filled in all the information, click the “Submit” button.

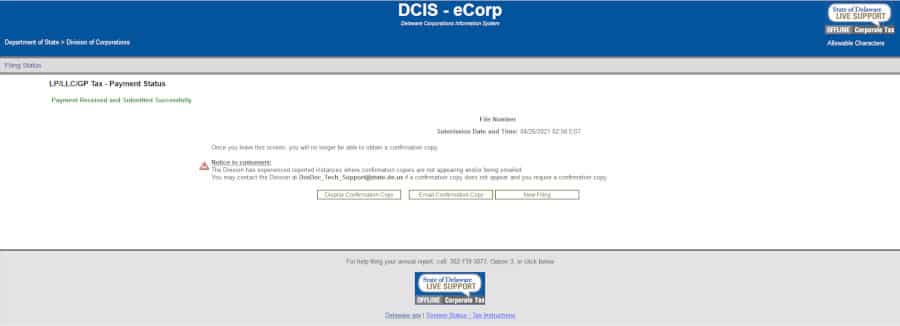

If your payment is successful, you should see the message “Payment Received and Submitted Successfully“:

You will receive a “Payment Acknowledgement Copy” in the email you entered the previous step.

It is possible to receive another email with a confirmation of payment by clicking on the “Email confirmation copy” button.

Other articles on administrative, financial, and tax information in the United States (USA)

We are interested in your opinion and advice on the settlement of the annual tax of a company in Delaware in the USA:

Tell us in the comments. THANK YOU.

Hi,

Thank you for your help. Your explanations on how to pay the annual tax in the state of Delaware are very helpful.