Bitcoin mining is increasingly being presented by influencers such as Victor Ferry as an accessible and potentially profitable source of income, particularly through platforms like GoMining.

However, behind the advertised figures, the actual profitability of mining depends on numerous, often poorly explained, factors: increasing mining difficulty, capital depreciation, temporary bonuses, and the upcoming halving.

This article offers a data-driven, fact-based analysis of GoMining, based on user experience, to compare its promises with the financial reality of Bitcoin mining and to assess the detrimental role of influencers, primarily on YouTube.

Contents

The Role of Influencers in Promoting GoMining

GoMining is primarily promoted on YouTube by influencers specializing in Bitcoin and alternative investments. Their content often highlights visible monthly earnings and personal testimonials, giving the impression that mining is simple and accessible.

This promotion is always conducted within an affiliate framework, creating an economic disparity between the influencer and the investor. This gap plays a key role in how the public perceives returns. Indeed, a YouTuber promoting a solution like GoMining via an affiliate code can generate a good return, while a typical investor will incur losses.

Mining: A Capital-Destructive Investment

Unlike other investments, mining has a fundamental characteristic that is often overlooked:

The invested capital is rapidly depleted over time.

The mining difficulty increases continuously, rendering the equipment obsolete quickly. Even with a regular income, the value of the capital inevitably tends toward zero.

Pedagogy: a comparative example of mining profitability

| Profitable investment | Unprofitable investment | |

| Initial investment | –1 000 $ | –1 000 € |

| Year 1 Revenue | 400 $ | 250 $ |

| Year 1 Revenue | 500 $ | 200 $ |

| Year 1 Revenue | 400 $ | 150 $ |

| Resale of the used miner | 300 $ | 50 $ |

| Cumulative income | 1 600 $ | 650 $ |

| Net result | +600 $ | –350 $ |

| Total profitability | +60 % | –35 % |

| Average annualized profitability | +20% | -11.67% |

👉 Having income on GoMining does not mean being profitable.

Video: My opinion after 4 months on GoMining vs. the discourse of influencers on YouTube

Why does the video published on Victor Ferry’s channel contain all the elements to mislead financially?

The video about GoMining, published on Victor Ferry’s channel, follows a narrative structure commonly used to promote certain alternative investments. This structure follows a well-defined pattern in which emotion precedes financial analysis.

The video begins with a sequence designed to create an atmosphere of tension and urgency. The French state is presented as being bankrupt, work no longer provides a decent living, and taxes are excessively confiscatory. The suggested conclusion is that it is imperative to “leave the system.” These statements may resonate with very real concerns, but they are not supported by verifiable figures that would allow for a concrete assessment of the profitability and risk of an investment.

Once this emotional framework is established, the video introduces an alternative presented as obvious: on the one hand, buying Bitcoin, an implicitly devalued option; on the other, mining Bitcoin, presented as a smarter or more committed choice. This opposition, however, is artificial. Buying Bitcoin and holding it in self-custody is a simple, transparent process that does not destroy invested capital and does not depend on a third-party intermediary.

By artificially contrasting buying Bitcoin with mining, the narrative pushes viewers toward the promoted mining solution without clearly comparing the essential elements: costs, risks, reliance on an intermediary, and long-term profitability. Yet, to judge an investment, the only question that matters is simple: what real return can one expect, with verifiable figures to back it up, over several months or several years?

What is the observed profitability of GoMining (user experience)?

To assess GoMining’s profitability, it is essential to rely on quantifiable data observed over time, rather than on theoretical projections or revenue figures reported at specific points in time.

Initial observed data

- Amount invested: $382

- Observed annual profitability: 20.21% since October 1, 2025

This figure may seem attractive at first glance. However, it corresponds to an initial period (Miner Bonus) and does not reflect the natural evolution of returns over time.

Analysis of profitability trends

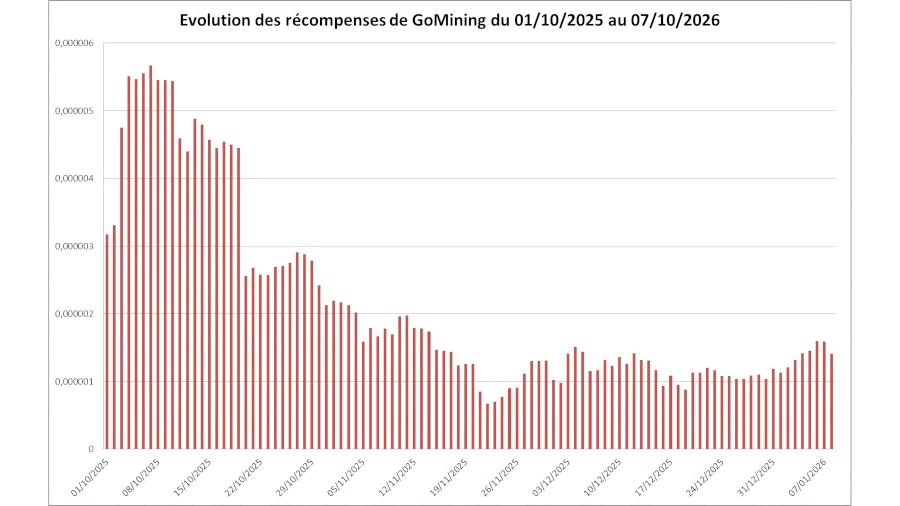

When we smooth the returns and consider the annualized trend, profitability drops to approximately 13.27% per year. At this rate, it would take more than 7.5 years simply to recover the initial investment, with a daily gain of approximately 120 satoshis.

In other words, long-term net profitability tends towards zero, even without accounting for future adverse factors such as the planned halving between May and June 2028.

Returns destined to decline

Several structural factors are exerting sustained downward pressure on mining returns:

- The continued increase in mining difficulty progressively reduces earnings per unit of computing power.

- The halving is expected around June 2028, halving rewards for block discovery.

It should be noted that miners also receive transaction fees, which partially mitigate the impact of the halving. However, these fees alone are insufficient to offset the structural decline in long-term rewards.

Based on the observed figures, the evolution of returns over time, and the structural constraints of mining, the GoMining model does not offer a sustainable return on investment for a typical investor.

Contrary to the returns highlighted in promotional content, investment tends to involve gradual capital erosion, leading, from a strictly economic point of view, to a high probability of loss in the long term.

The figures presented in Victor Ferry’s video regarding GoMining’s profitability are misleading.

The figures presented in the video are:

- Investment: $9,000,

- Monthly income: $300,

- Resulting return: 40% per year.

The approximately 40% profitability is primarily due to the initial 15-day “Miner Bonus.” Once this bonus expires, daily earnings gradually decrease and then stabilize at a much lower level. Tracking my earnings day by day (see graph) clearly demonstrates a downward trend.

GoMining is not profitable beyond a one-month timeframe.

My recommendation for those who actually want to mine:

If you’re mainly interested in mining out of curiosity or for fun, or to earn a few satoshis, you can follow Ulrich’s YouTube channel, “Café Viennois,” which recently published a video on “warming up while mining.” And with this approach, you truly become a participant in the Bitcoin network :).

Buying Bitcoin in self-custody?

Investing directly in Bitcoin simply means buying it and holding it in self-custody (you keep your keys). To do this, you can use a platform like Bull Bitcoin, then transfer your BTC to your own wallet.

Frequently Asked Questions (FAQ) about GoMining profitability

Other articles about Bitcoin and cryptocurrencies

We’d love to hear your opinion on GoMining’s profitability for investors:

Share your thoughts in the comments. Thank you.