On Monday, November 24, 2025, Eric Larchevêque announced, with a major publicity campaign, the creation of a “Bitcoin Treasury Company” in France, similar to MicroStrategy in the United States. The project, called “The Bitcoin Society” (TBSO), aimed to build a collective Bitcoin reserve while bringing together a community committed to financial autonomy and freedom. The entire Bitcoin community in France unanimously rejected the proposal: let’s try to understand the reasons behind this rejection.

Contents

What is a Bitcoin Treasury Company?

A Bitcoin Treasury Company uses Bitcoin as a cash reserve—that is, it holds a significant portion of its liquidity in BTC rather than euros, dollars, or other traditional currencies (such as stocks or bonds).

Importantly, the company’s valuation is primarily linked to its Bitcoin holdings, even if it may also provide services (as is the case with MicroStrategy).

Who is Éric Larchevêque?

Eric Larchevêque is a French entrepreneur and investor, born on September 30, 1973, in Boulogne-Billancourt. He is best known as the co-founder of Ledger, the company that designs hardware wallets for cryptocurrencies to secure users’ private keys.

He also co-founded the former “La Maison du Bitcoin” (now Coinhouse), one of the first physical cryptocurrency exchanges in Europe.

What is Eric Larchevêque’s value proposition?

Eric Larchevêque’s value proposition with The Bitcoin Society (TBSO) is to offer simple, regulated access to Bitcoin through a listed company while uniting a community of entrepreneurs and investors around a vision of financial sovereignty.

Investors can acquire shares in The Bitcoin Society (TBSO) and benefit from Bitcoin’s advantages. The structure offers indirect exposure to Bitcoin, comparable to that of specialized ETFs.

Mon avis en vidéo sur "The Bitcoin Society", alias @_TBSO d’Éric Larchevêque #tbso #bitcointreasury – https://t.co/ZYK6Uyfzm0 – @EricLarch – @Dark_Emi_

— Juristique (@Juristique_) December 1, 2025

Une « Bitcoin Treasury Company » est tout le contraire d'un outil pour un individu souverain. En effet, vous êtes propriétaire…

Instead of pursuing a traditional IPO, which is often lengthy, expensive, and uncertain, the founders opted for a faster route: acquiring an already listed company, Société de Tayninh.

Dormant for nearly ten years and listed on Euronext Paris under the ticker symbol TAYN, it was previously owned by Unibail-Rodamco-Westfield. The three founders, through their holding companies (Quatre Vingt Dix, Nuku Hiva Holding, and Infinity Nine Promotion), have thus acquired 97.68% of the share capital at €0.11 per share.

The completion of the transaction is expected in the coming weeks, followed by the filing of a simplified public tender offer with the AMF (French Financial Markets Authority). The firm Crowe HAF is responsible for validating the deal’s financial valuation.

Important: this does not mean, as has been reported, that Éric Lachevêque and his partners are only offering 3% of the company. No, this company will have to carry out a capital increase, which will dilute existing shareholders.

But what’s the problem with “The Bitcoin Society” and its founder, Eric Larchevêque?

Under normal circumstances, the creation of a “Bitcoin Treasury Company” would have generated enthusiasm within the Bitcoin community and, at worst, indifference. Of course, no one can claim to represent it; I can only offer my personal opinion.

The launch of “The Bitcoin Society” was preceded by a series of videos on Eric Larchevêque’s YouTube channel. All the videos emphasized the values of freedom associated with Bitcoin ownership and resilience against a centralized state.

Before transforming the world, Bitcoin transforms humanity. It changes the mind. It forces us to slow down, to anticipate, to become worthy of our future. And one day, without even realizing it, we understand that we not only have a more robust asset, but also a calmer mind, a more stable outlook, a freer life, and a more peaceful mental load. Bitcoin has given me freedom and inner peace that no one and nothing else has ever provided.

Bitcoin: What no one tells you when you buy it | Eric Larchevêque

These videos sparked great hope. Indeed, in a tax environment perceived as exploitative, Bitcoin embodies the hope of regained economic sovereignty, where everyone takes back control of the value they create.

In my Bitcoin community, many people were even convinced that Eric Larchevêque would run in the next presidential election.

The Disappointment Sparked by Eric Larchevêque’s Announcement of “The Bitcoin Society”

A “Bitcoin Treasury Company” is the very opposite of a tool for a sovereign individual. Indeed, you own shares, not Bitcoin itself, according to the regulatory framework. Added to this are additional risks compared to direct Bitcoin ownership (known as self-custody): the French state, which can impose taxes (Corporate and dividend taxes, social security contributions, CSG-RDS, etc.), and the risk of ownership by a third party. Additional fees must also be anticipated compared to direct ownership.

The creation of “The Bitcoin Society” is the exact opposite of what Eric Larchevêque promoted in all his YouTube videos. While Eric Larchevêque’s entourage is surprised that his project isn’t gaining traction, the real problem lies in the glaring inconsistency between the stated promise and the reality of the value proposition.

Moreover, the legal structure will be a “Société en Commandite par Actions” (partnership limited by shares), even though it intends to raise funds from the public. By being publicly listed while remaining an SCA, the company’s control will stay in the hands of the general partners — meaning Eric Larchevêque himself. This imbalance in governance will therefore limit shareholders’ influence and could result in a financial discount.

Eric Larchevêque justifies this by saying, “I don’t want an external company to take control and sell the bitcoins.” I believe, on the contrary, that power should remain in the hands of the shareholders. If the management fails to perform, shareholders must have the ability to replace it. That should also apply to Eric Larchevêque and his team.

Video: independent review of The Bitcoin Society by Éric Larchevêque

My opinion on “The Bitcoin Society”: Should you invest in Eric Larchevêque’s offering?

The Bitcoin Society (TBSO) allows you to invest in Bitcoin without managing the technical aspects yourself. However, this approach carries additional risks compared to individual ownership. I therefore prefer buying Bitcoin in “self-custody,” particularly through BullBitcoin.

Regarding the investment and entrepreneurship support services, I don’t have a strong opinion. But this isn’t the core of Eric Larchevêque’s value proposition. It’s worth noting that these services will be housed in separate legal structures, which is a positive point.

Finally, the discourse is now shifting towards the establishment of a “Network State.” Here again, there’s a feeling that an illusion is being created to sell the reality of the “Bitcoin Treasury Company.”

In any case, Eric Larchevêque’s approach should be commended, because even if the project does not appeal to me, it ultimately brings new people to Bitcoin.

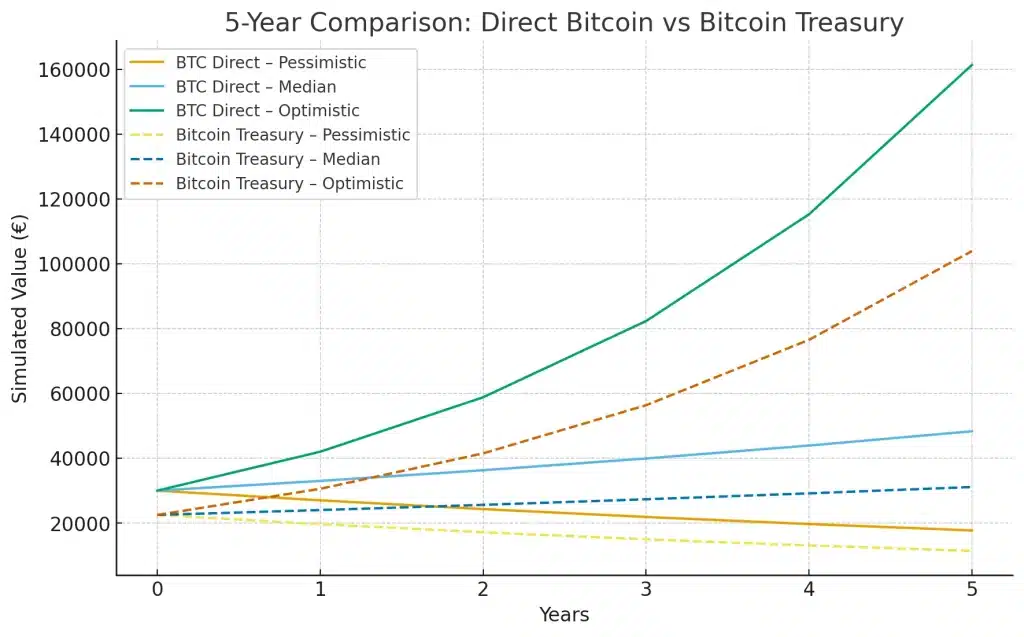

Comparative performance analysis between direct bitcoin ownership and ownership via a Bitcoin Treasury

This chart highlights the performance gap between two strategies: buying Bitcoin directly and holding it yourself, or investing in a company that holds Bitcoin on your behalf.

In all three simulated scenarios (pessimistic, median, optimistic), direct ownership consistently outperforms the “Bitcoin Treasury” model. Why? Within a company, potential gains are reduced by operating costs, taxes, governance, and possible share dilution.

In other words, the investor bears the same risks as Bitcoin… but without fully benefiting from them. Sovereignty and return go hand in hand: holding your BTC yourself remains more financially efficient and more philosophically consistent.

Importantly, we must wait for the Autorité des marchés financiers et de la protection de l’épargne (AMF) to rule on the project. To my knowledge, this has not yet happened.

Frequently Asked Questions (FAQ) about “The Bitcoin Society” by Eric Larchevêque

Other articles about Bitcoin and cryptocurrencies

We’d love to hear your thoughts on Eric Larchevêque’s “The Bitcoin Society”:

Let us know in the comments. THANK YOU.