Being able to instantly calculate the true cost of your loan is essential before committing, whether it’s for a mortgage or a personal loan. This free simulator allows you to obtain, in just a few seconds, the monthly payment and the total cost of the loan, so you know precisely the real price of your financing.

Instantly see the impact of the loan term, interest rate, and insurance on your loan. Easily compare offers and make a clear, secure decision without any unpleasant surprises.

Contents

Simulator for calculating the monthly payment and cost of a mortgage or consumer loan 👇

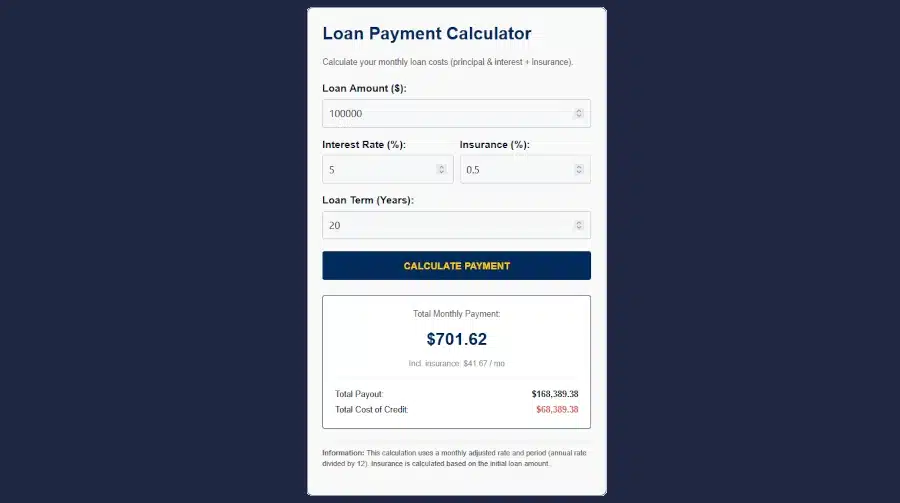

Loan Payment Calculator

Calculate your monthly loan costs (principal & interest + insurance).

Information: This calculation uses a monthly adjusted rate and period (annual rate divided by 12). Insurance is calculated based on the initial loan amount.

Why divide the annual rate by 12? Mortgages and consumer loans most often use the proportional rate method. Unlike savings accounts, which often use an actuarial rate, loans break down each year into 12 identical periods for complete transparency regarding the cost of each monthly payment.

- The rate: Monthly rate = Annual rate / 12.

- The duration (period): Number of monthly payments = Number of years × 12.

All the steps are explained to use our mortgage and consumer loan payment and cost calculator

Step 1: Prepare and enter the values

- The amount of capital borrowed for your project,

- The annual interest rate,

- The annual insurance rate,

- The loan term in years.

Step 2: Click the "Calculate monthly payment" button

The program provides the following results:

- The monthly payment amount,

- The cost of insurance,

- The total cost of the loan (total amount repaid) with a breakdown of insurance and interest.

FAQ: Everything you need to know about calculating a monthly payment and the cost of a loan (mortgage or consumer loan)

Other online tools available on Juristique

The tools offered by Juristique® allow you to easily carry out legal and administrative procedures as well as financial calculations and optimization online.

We'd love to hear your opinion and feedback on our loan payment and cost calculator:

Tell us in the comments. THANK YOU.