That’s it, Duralex is saved. Again! If there’s one quality to acknowledge about Duralex and its leader, it’s their fighting spirit. Indeed, Duralex should have died a thousand times over, but it’s still standing. The newspaper “Les Échos” has just announced that Duralex has successfully raised funds through a crowdfunding campaign on the Lita platform.

“We’re on cloud nine. It’s a historic success,” confided Duralex CEO François Marciano. The general public responded massively to the pre-fundraising campaign for this iconic brand. More than 21,000 people reserved their participation, with an average ticket price of €910. “Such enthusiasm in such a short time is unprecedented,” rejoiced Julien Benayoun, co-founder of the platform.

Contents

Who is Duralex?

Duralex is a French brand founded in 1945, renowned for its ultra-resistant tempered glassware, particularly the iconic “Picardie” model.

Manufactured in La Chapelle-Saint-Mesmin, its products are resistant to impacts and extreme temperature variations. Its name comes from the Latin phrase “Dura lex, sed lex,” meaning “The law is harsh, but it is the law.”

From its inception, Duralex became renowned for its tempered glass technology, which makes its products virtually unbreakable and resistant to thermal shock. A symbol of French craftsmanship, Duralex remains an icon in canteens and kitchens worldwide.

Recent History of Duralex

Despite its strong brand recognition, the company has experienced numerous financial difficulties, including successive liquidations and takeovers. It was notably acquired in 2021 by Pyrex, another iconic brand of glassware.

| Date | Event | Implications |

| January 2021 | Rising gas costs, furnace shutdowns, and partial unemployment among employees. | Objective: to revive the brand through industrial synergies and modernize the La Chapelle-Saint-Mesmin factory. |

| February 2022 | International Cookware becomes “La Maison française du verre“. | New strategic positioning to bring together French glassmaking expertise. |

| November 2022 – April 2023 | Energy crisis: Duralex suspends production for several months. | Rising gas costs, furnace shutdowns, partial unemployment for employees. |

| April2024 | Duralex has been placed under judicial administration by the Orléans commercial court. | High risk of the company and brand disappearing. |

| July 2024 | Takeover in the form of a SCOP (cooperative and participatory company) by the employees. | Takeover in the form of an SCOP (Worker cooperative) by the employees. |

| 2025 | Launch of a citizen fundraising campaign to modernize the factory and consolidate operations. | More than 7,000 individuals are participating in the financing; the brand is initiating an industrial and social renewal. |

Duralex’s fundraising: launch of a participatory loan

In its latest development, Duralex is launching a fundraising campaign through a participatory loan on the Lita crowdfunding platform.

The Lita Platform

Lita.co is a French crowdfunding platform founded in 2014, dedicated to projects with a social, environmental, or solidarity impact. It enables individuals to become shareholders or lenders in companies dedicated to a sustainable transition.

Lita aims to be an alternative to speculative finance by bringing citizens closer to the real economy.

Investment amounts generally start at €100, making it accessible to a wide range of people. The platform is authorized by the French Financial Markets Authority (AMF) as a crowdfunding investment advisor. However, the investments offered often remain risky and unguaranteed, as they rely on fragile business models.

Duralex participatory securities

Participatory securities are interest-bearing debt securities, considered quasi-equity for the cooperative. Here are the characteristics of Duralex’s participatory loan for this fundraising round:

- Repayment period: Participatory securities are redeemable only from the 7th year onwards. The redemption date is not contractually binding; this means that the cooperative reserves the right to extend the investment period and reimburse investors after seven years.

- Fixed and variable interest rate: Participatory securities pay a fixed interest rate for investors, defined in advance by an issuance agreement. For Duralex’s fundraising, the interest rate is 8% per year for 7 years, then an additional 1% per year.

- No voting rights or equity stake: Unlike cooperative shares, participatory securities do not grant voting rights at general meetings or any equity stake in the cooperative.

- Investment risks: This investment carries significant risk and involves a degree of uncertainty about the future. Only invest if you are prepared to lose the amount you have invested.

There is a withdrawal period for inexperienced investors. Once your investment has been made (by signing the electronic form and paying the funds to LITA), you have a 4-day period to withdraw, during which LITA may fully reimburse you for the funds (including subscription fees).

Fees and Commissions Applied by Lita

LITA applies a commission only upon subscription. This commission is tiered, ranging from 3.5% to 1.5%, depending on the amount invested. It covers the costs of electronic signature, secure payment, file management, and representation with the company to defend investors’ interests. There are, however, no fees during the investment period or upon exit.

The Benefits of the Participatory Loan

- Financing the purchase of new molds for product manufacturing.

- Equipping the factory with a new packaging machine to open new markets with major players in the agri-food sector.

- Improving the productivity and safety of the production lines.

Duralex released economic indicators for 2025 for the launch of the participatory loan

| Revenue | 32 M€* |

| Operating profit | 6.2 M€* |

| Equity | 8.9 M€* |

| Debts | 3.8 M€* |

| Net result | Not published? |

| Over 14 months, from 01/08/2024 to 30/09/2025 – exceptional items related to the takeover to be restated | |

Opinion on the participatory loan launched by Duralex

The financial viability of Duralex

The peer-to-peer lending initiative launched by Duralex via the Lita.co platform has garnered significant media attention, but a closer look at the figures suggests a much more cautious approach.

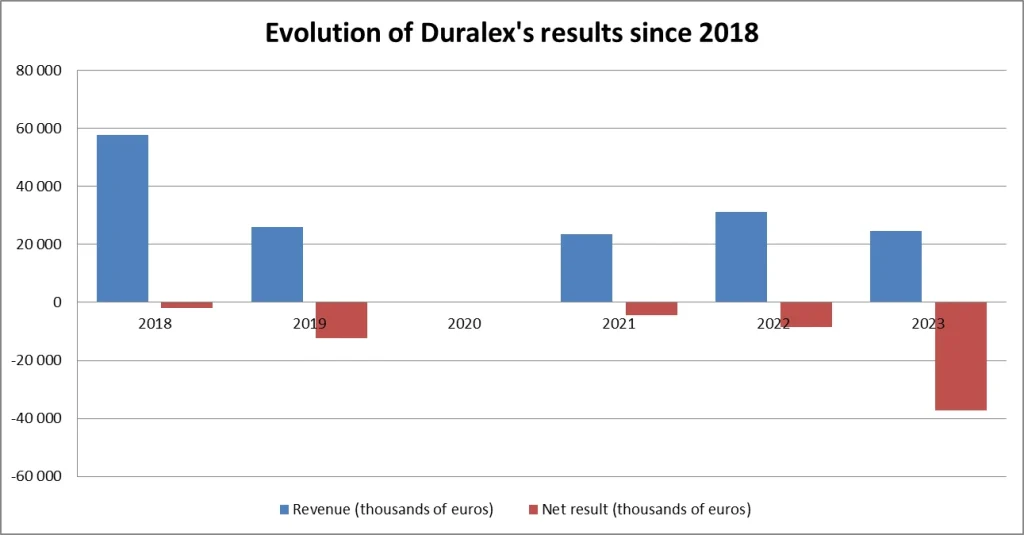

Since 2018, Duralex has posted consecutive years of losses. According to the latest available financial statements, its cumulative net income for the period 2018-2024 reached nearly -€64 million (excluding 2020 figures), with particularly sharp losses in 2023 (-€37.3 million). Over the same period, revenue was halved, falling from €57.8 million in 2018 to €24.6 million in 2023, while maintaining a stable workforce of approximately 230 employees.

In other words, the company is no longer creating value. It is consuming capital.

Despite this situation, Duralex has already received over €19 million in public aid, representing approximately 80% of its annual revenue, through direct subsidies, guarantees, and emergency loans. It is, therefore, taxpayer money that is currently sustaining the business.

A fundraising campaign lacking transparency and highly risky

The terms of the participatory loan and the accompanying documents are more about communication than corporate finance. The announced conditions:

- A fixed interest rate of 8% per year for 7 years, then +1% per year thereafter,

- A minimum term of 7 years, but repayment is not guaranteed: the cooperative can defer payment at its discretion.

- No voting rights or equity stake for investors,

- A high risk of capital loss, acknowledged by the platform itself.

Even worse, no audited financial statements, a complete business plan, or verifiable financial projections were published at the time the fundraising campaign was launched. The only accessible documents are a sales pitch and the cooperative’s bylaws.

Adding to this is a paradox: Duralex, the worker cooperative (SCOP), supposedly embodying employee autonomy, remains heavily subsidized, which contradicts the very principle of self-management. This model is based less on economic performance than on a symbolic narrative, that of the “heritage brand to be saved“.

Return on Capital and Borrowing: The Duralex Case

The real return on capital reflects a company’s ability to transform invested funds into sustainable profit. In other words, it measures the amount of new wealth generated by each euro invested in the business. When it falls to zero (worse, Duralex is losing money), it means that the capital no longer creates value: it produces neither profit nor growth, and serves only to keep the machine running. In such a situation, each new financial injection merely cushions the fall, without restoring overall profitability.

In the case of Duralex, borrowing at 8% in this context therefore amounts to paying a very high price for unproductive capital. This is a case of reversed logic: in a healthy economy, borrowing is only done when the expected return exceeds the cost of borrowing. Here, Duralex is taking on debt not to invest, but to survive, to cover its structural losses rather than to finance profitable development.

In practice, this participatory loan does not create added value: it artificially keeps a loss-making model alive, while transferring the risk onto individual investors seduced by an illusory return.

It is indeed surprising that banks are not rushing to finance investments through loans. That is normally their role.

Lita.co Reminds Investors of the Risks of the Duralex Deal

The crowdfunding platform Lita is protecting itself by clearly stating in all documents that this is a risky investment.

Risk Analysis

| Operations | Medium risks |

| Business model | High risks |

| Yield/Liquidity | High risks |

Selected excerpts from the analysis by Lica.co

Risk factors: constraints related to SCOP status restricting the ability to strengthen equity and absence of a balance sheet in 2026 which limits sources of financing at this stage.

Mitigating factors: support from public institutions (metropolis, Bercy) within the framework of the recovery plan.

Duralex has long since ceased to be a company and has become a symbol

The press presents Duralex’s takeover as a worker cooperative (SCOP) as an exemplary success: a symbolic victory for employees over the traditional capitalist model, the embodiment of a so-called more “humane” economy.

But on closer inspection, this narrative quickly crumbles. If the company is still operating today, it is not because it has discovered a solid business model or conquered a sustainable market. It is because it lives on constant public assistance. Since 2022, Duralex has reportedly received more than €19 million in public aid, representing nearly 80% of its annual revenue. Emergency loans, bank guarantees, and support mechanisms through Bpifrance: everything has been mobilized to artificially keep a business alive that is no longer profitable in a typical competitive environment. Duralex is a company on “public funding.” Behind the militant rhetoric of industrial resilience lies a form of soft state control, where taxpayers finance the survival of a company that has become structurally unprofitable.

Far from guaranteeing employee autonomy, this model creates the illusion of it: a subsidized autonomy, dependent on the goodwill of the state and without any clear prospect of sustainable private income.

As long as the subsidies last, the heroic narrative will continue. However, when the subsidies run dry, economic reality will quickly return.

Video: The truth about Duralex – an investment in a high-risk peer-to-peer loan

To learn more about the participatory loan offered by Duralex

Two links for further information:

- Duralex: Lita’s financial terms.

- Lica.co crowdfunding platform: Duralex fundraising.

Frequently Asked Questions (FAQ) about Duralex’s participatory loan

Download the latest financial statement for DURALEX

Other articles and financial analyses

We’d love to hear your opinion on DURALEX’s participatory loan:

Tell us in the comments. THANK YOU.